You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce. The calculator will not only calculate the margin itself but will also return the contribution margin ratio. For small business owners, effectively using a 9 ways your firm can find new clients means regularly updating it with accurate data.

What is the difference between the contribution margin ratio and contribution margin per unit?

An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future. 4) You can use contribution margins for understanding the potential impact of new rules and regulations on your business, including changes in reimbursement rates from Medicare and Medicaid and new laws such as HIPAA. The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68.

Integrating Contribution Margin Analysis into Business Reviews

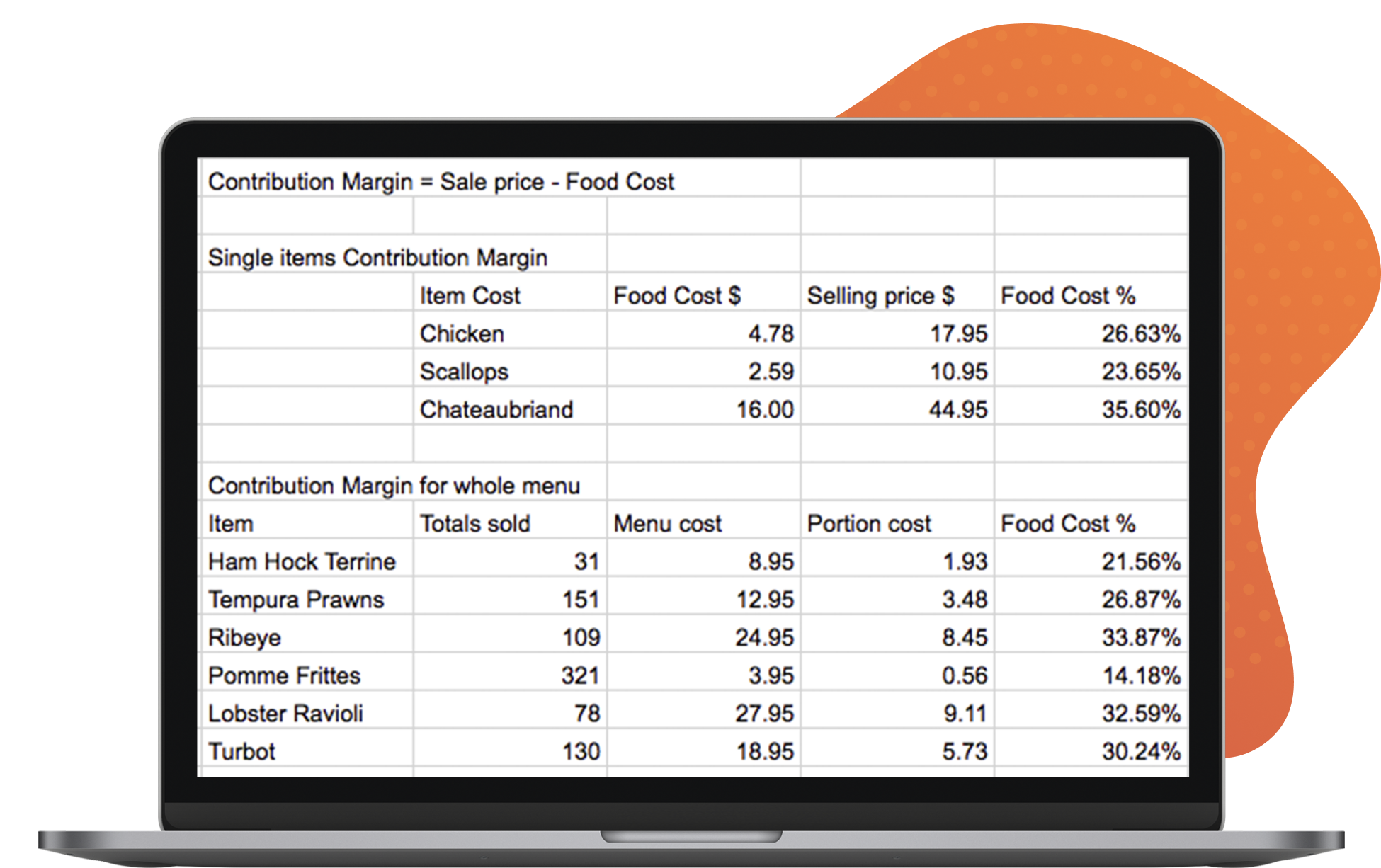

This example illustrates how understanding the contribution margin and contribution margin ratio can guide decisions related to pricing, product selection, and sales volume. For a small business owner, these insights are invaluable in achieving the break-even point and surpassing it towards profitability. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good. This is one of several metrics that companies and investors use to make data-driven decisions about their business.

How to Calculate Contribution Margin

The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. The contribution margin is given as a currency, while the ratio is presented as a percentage. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Finance Strategists has an advertising relationship with some of the companies included on this website.

Insights into Cost Structure and Profitability

Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated.

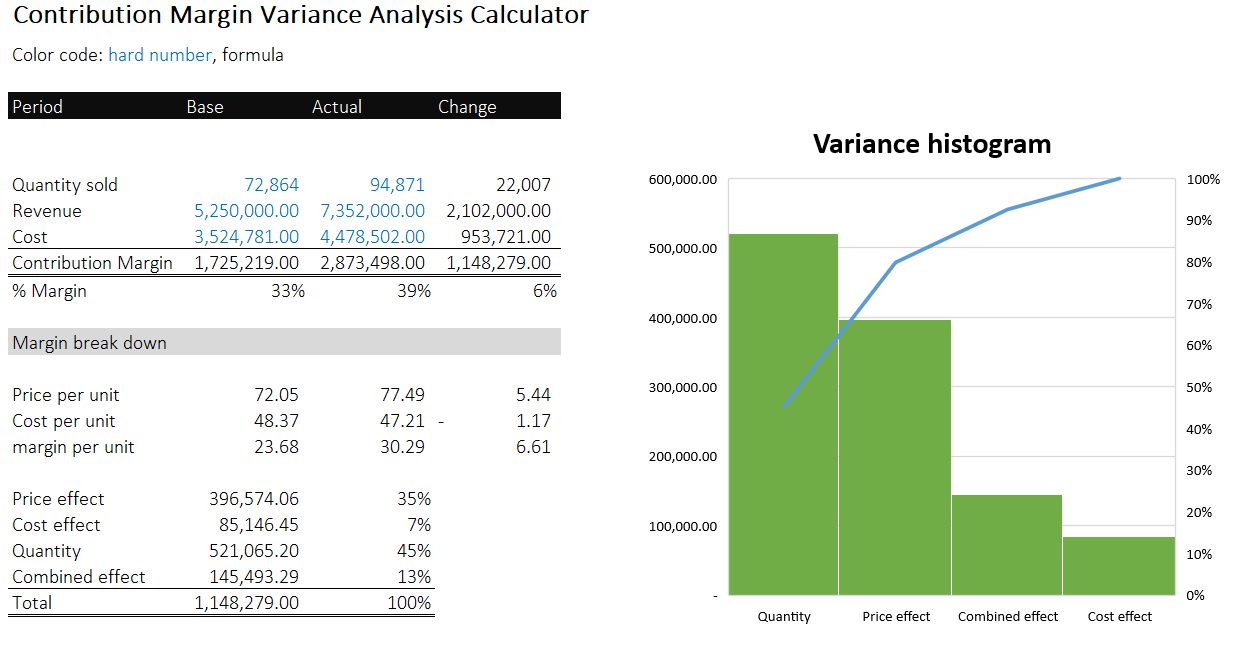

For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product. Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold. Knowing how to calculate the contribution margin is an invaluable skill for managers, as using it allows for the easy computation of break-evens and target income sales. This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses.

- In such cases, the price of the product should be adjusted for the offering to be economically viable.

- It is calculated by dividing the contribution margin per unit by the selling price per unit.

- Additionally, understanding the financial ratios that emerge from this analysis can guide strategic decisions.

- The calculator then processes these inputs to deliver not just the contribution margin but also the contribution margin ratio and the total profit generated.

It’s how valuable the sale of a specific product or product line is. It is the monetary value that each hour worked on a machine contributes to paying fixed costs. You work it out by dividing your contribution margin by the number of hours worked on any given machine. A contribution margin analysis can be done for an entire company, single departments, a product line, or even a single unit by following a simple formula.

A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit. Management uses the contribution margin in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line. Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues.